INFLATION is slowly dropping but what is it and what does a decrease mean for households?

The UK's rate of inflation fell once again to 6.7% in August, according to the Office for National Statistics (ONS).

The Consumer Price Index level of inflation decreased from 6.8% in July.

It means that while costs are still going up, the rate at which they are rising is increasing.

August's drop was partly down to falls in the costs of things such as hotel stays or flights.

The largest contribution towards the slight decrease came from food, where prices rose by less in August than they did a year ago.

The increase in the prices of petrol led to the largest upward contribution to the change in annual rates.

We've broken down everything you need to know.

What is inflation?

Inflation is a measure of how much goods and services are worth in a given period.

This means how much the price of goods, such as food or televisions, and services, such as haircuts or train tickets, has changed over time.

It is known as a "backward-looking measure", which means it indicates what has happened over the past year.

That obviously means that it does not predict the future.

The rate of inflation is published each month by the Office for National Statistics (ONS).

It's a non-ministerial department which reports directly to Parliament.

MOST READ IN MONEY

We DOUBLED our winnings in £1m lotto jackpot – why we didn’t want to claim it

Huge change to your takeaways within days after ban – shoppers will be divided

Brits to receive £300 Cost of Living cash in just weeks – see if you qualify

Full list of benefits that DON’T qualify for £300 payment coming in weeks

How does inflation impact prices?

Inflation doesn't impact prices, rather it's a measure of how prices have changed over the past year.

When it goes up, it means prices on everyday items, essentials, fuel and bills are higher.

That means millions of households' budgets are squeezed.

The latest publication looked at prices in the 12 months to August 2023 compared to the previous year.

For example, the ONS said inflation of food and non-alcoholic beverage prices saw an annual rise of 0.3% between July and August, down from a 1.5% rise between the same months last year.

What causes inflation?

The inflation rate depends on how the prices of a basket of goods and services have changed over the past year.

Inflation is measured by the ONS, which collects around 180,000 prices of about 700 goods and services used across the country.

These prices are updated every month with officials visiting the same retailers each time to ensure consistency.

The prices are then weighted with more prominence being given to products people buy more often, such as fuel rather than postage stamps, for example.

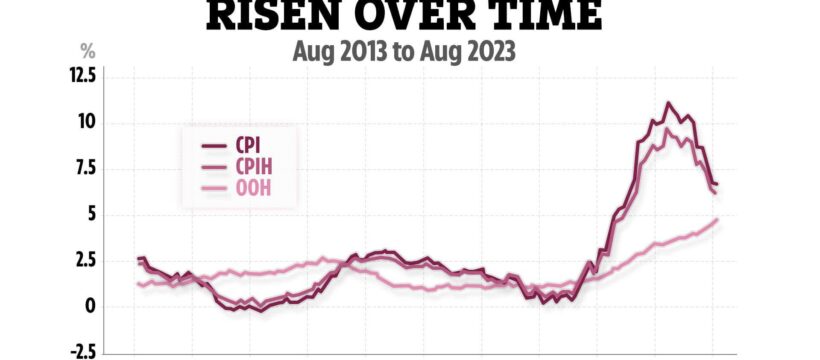

There are numerous different measures of inflation that all track slightly different baskets of goods. The main measure is known as the Consumer Prices Index (CPI), and state benefits and the state pension also rise in line with it.

There is also a Consumer Prices Index including housing costs (CPIH) measure, as well as a Retail Prices Index (RPI) measure, which is used to calculate annual rail increases and student loan interest rates among other things.

What is the UK's current inflation rate?

The CPI measure of inflation dropped to 6.7% in August 2023, the latest figures available show.

In July, the rate was slightly higher at 6.7%, but had dropped more from 7.9% in June.

In May, inflation stood at a larger 8.7% which was unchanged from April.

The slowdown is good news for stretched households, although inflation still remains high.

What does inflation mean for prices and the economy?

Inflation matters because it affects the value of wages, savings and more. The Bank of England has a target inflation rate of 2%.

This target is set by the government, which believes a small amount of inflation at a stable level is good for the economy.

That's because it boosts economic output by encouraging spending, which in turn means businesses can afford to generate employment opportunities.

It can also make goods more attractive to foreign buyers as it can make their currency worth more, comparatively, to other countries.

However, if inflation is too high or goes up and down a lot, it can be hard for businesses to set the right prices and for people to plan their spending.

It can also mean the cost of essential goods and services can suddenly outstrip the buying power of people's wages – this is what we are seeing in the current cost of living crisis.

At the other end of the scale, it's also a problem if inflation is too low or negative, as people may put off spending because they expect prices to fall further.

What is deflation?

Deflation – or negative inflation – is when the rate of inflation falls below zero.

This can happen when the supply of goods is higher than the overall level of demand. It can also be triggered by lower production costs, or a shortage of money in circulation.

The UK was last in deflation territory in 2015, but some experts previously speculated we could see negative inflation due to earlier coronavirus pressures on the economy.

This would mean lower prices for consumers, which on the surface is a good thing.

But the Bank of England points out that when prices fall, people often don't make purchases as they hope costs will fall further.

When people stop buying, less money is going into businesses and the economy, which can lead to recession, wage cuts and job losses.

How can I protect my finances against high prices?

The best way to beat the price hikes as inflation remains high is to check your finances and see where you can cut costs.

Find a high-interest savings account if possible to try and make sure your money is growing in line with inflation.

Some banks are offering you free cash if you switch your current account.

Here's a little-known website where you can get groceries cut down to as little as 9p.

Shopping for own brand products is another easy way to cut your grocery bill.

If you are remortgaging, make sure you shop around and don't just assume your current provider can offer you the best deal.

When your deal ends you'll be put on the standard variable tariff, which at the moment might work out cheaper than the best fixed-rate deals because interest rates remain high.

Source: Read Full Article