‘Buy now, pay later’ debt a slippery slope for consumers: Retail expert

SW Retail Advisors founder Stacey Widlitz addresses rising credit debt as inflation persists on ‘Cavuto: Coast to Coast.’

Apple is taking advantage of the growing trend of buy now, pay later services.

The maker of iPhones, iPads, and MacBooks announced Tuesday that it launched Apple Pay Later in the U.S., giving customers the ability to split purchases into four separate interest-free payments.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 157.65 | -0.63 | -0.40% |

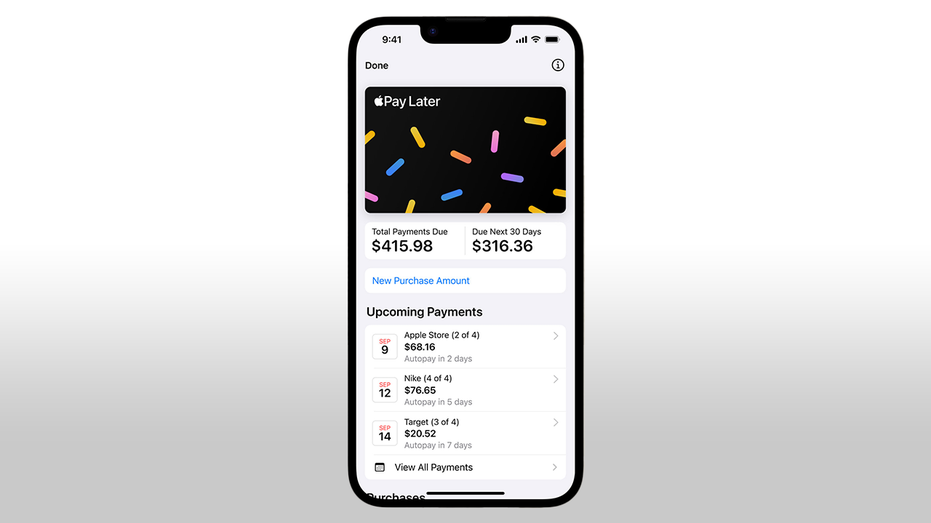

The payments will be spread over the course of six weeks and users will be able to track the payments in their Apple Wallet, according to Apple.

AS ‘BUY NOW, PAY LATER’ PLANS GROW, SO DO DELINQUENCIES

Shoppers can apply for loans between $50 to $1,000, which can then be used for online and in-app purchases that are made on either an iPhone or iPad.

Select users will also be given access a prerelease version of Apple Pay Later before its offered to all users in the coming months, according to Apple.

Apple launches Apple Pay Later in the U.S. (Apple) This can be seen as a major competitor to companies such as Afterpay or Klarna which have dominated the space. The companies require shoppers to download their app and link their bank account or debit or credit card. They can then sign up for weekly or even monthly payment installments. BUY NOW, PAY LATER EXPANDING TO STOREFRONTS AND GAS PUMPS Some companies, including Apple, will do a soft credit check beforehand to make sure users are in good financial shape to accept the loans. Apple launched the service as more shoppers are leaning on buy now, pay later services as inflation continues to erode household budgets, according to Adobe Analytics' latest retail report. Although inflation is easing, climbing 6% in February, it's still far above the Federal Reserve's target of 2%. Within the first two months of 2023, the share of online purchases using such services grew 10% year over year, according to recent data from Adobe Analytics. The number of grocery shoppers using buy now, pay later services grew 40%. Home furnishings, another popular category in which consumers have been delaying payments, grew 38% during the same period. Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said in a statement that there is no "one size fits all approach" to managing finances and acknowledged that shoppers "are looking for flexible payment options." "Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions," Bailey said. GET FOX BUSINESS ON THE GO BY CLICKING HERE Mary Kissel, former senior adviser to Secretary of State Mike Pompeo, discusses the ongoing protests in China and the role corporate America is playing in the expansion of the Chinese government. Source: Read Full Article

Why Apple’s Board of Directors should be looked at closely amid China protests: Mary Kissel